Do Tampons Qualify For Hsa . the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. The irs has a broad list of expenses related to medical, dental, and. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. did you know that you can access qualifying lola products for period care and sexual wellness by using your.

from www.youtube.com

this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. did you know that you can access qualifying lola products for period care and sexual wellness by using your. The irs has a broad list of expenses related to medical, dental, and. tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements.

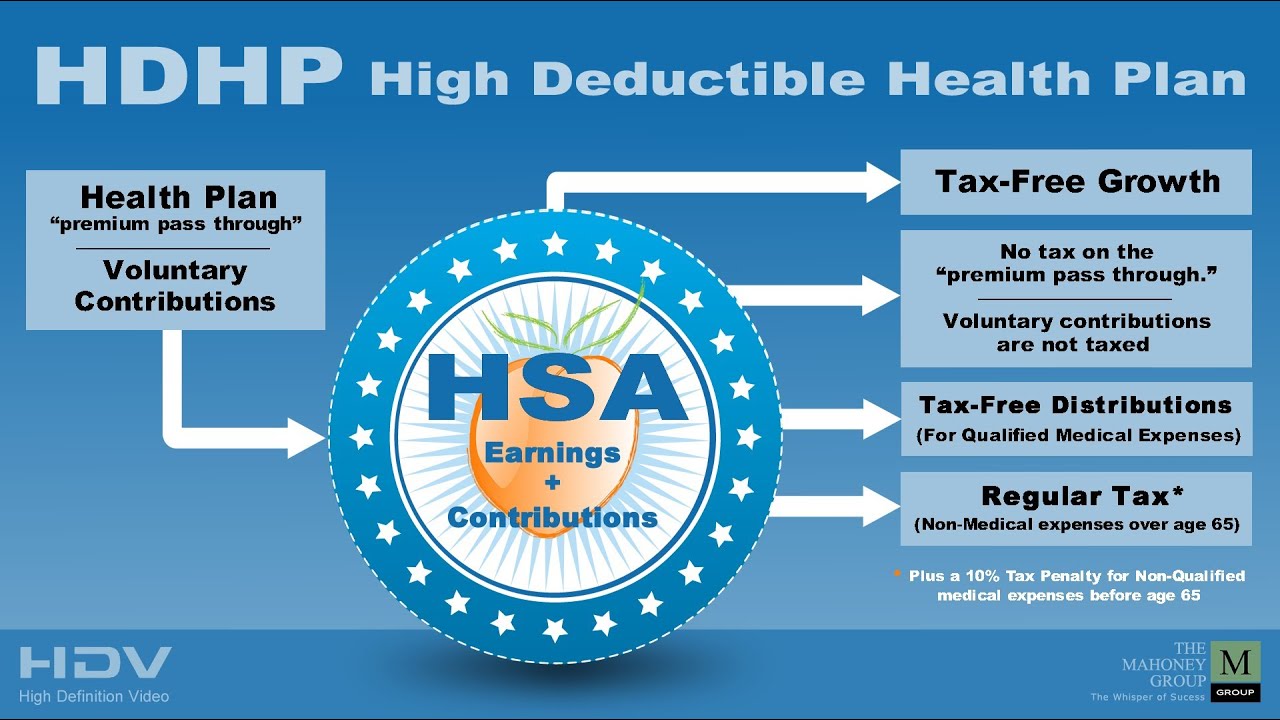

HDHP High Deductible Health Plan, YouTube

Do Tampons Qualify For Hsa the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. The irs has a broad list of expenses related to medical, dental, and. the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. did you know that you can access qualifying lola products for period care and sexual wellness by using your.

From thinkhealth.priorityhealth.com

What is an HSA and Will It Change Under the New Health Bill? ThinkHealth Do Tampons Qualify For Hsa the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. did you know that you can access qualifying lola products for period care and sexual wellness by using your. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. The irs has. Do Tampons Qualify For Hsa.

From www.peoplekeep.com

How to tell if your HDHP is HSAqualified Do Tampons Qualify For Hsa The irs has a broad list of expenses related to medical, dental, and. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. tampons are eligible for reimbursement with a flexible spending. Do Tampons Qualify For Hsa.

From www.knixteen.com

How To Use A Tampon For The First Time Do Tampons Qualify For Hsa this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. did you know that you can access qualifying lola products for period care and sexual wellness by using your. The irs has a. Do Tampons Qualify For Hsa.

From blog.axcethr.com

2019 FSA and HSA Contribution Limits Do Tampons Qualify For Hsa The irs has a broad list of expenses related to medical, dental, and. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. did you know that you can access qualifying lola products for period care and sexual wellness by using your. tampons are eligible for reimbursement with a flexible spending account. Do Tampons Qualify For Hsa.

From www.fitclubny.com

Everything You Need To Know About HSA and FSA Cards! Do Tampons Qualify For Hsa tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. did you know that you can. Do Tampons Qualify For Hsa.

From kutakizikazukuchiri.norushcharge.com

Tampon Stuck Symptoms, What to Do, Infection Risk, and More Do Tampons Qualify For Hsa the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. did you know that you can access qualifying lola products for period care and sexual wellness by using your. The irs has a broad list of expenses related to medical, dental, and. the recent changes in legislation known as the. Do Tampons Qualify For Hsa.

From www.gosupps.com

Flex Menstrual Discs Disposable Period Discs Tampon, Pad, and Cup Do Tampons Qualify For Hsa The irs has a broad list of expenses related to medical, dental, and. did you know that you can access qualifying lola products for period care and sexual wellness by using your. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. the recent changes in legislation known as the. Do Tampons Qualify For Hsa.

From mariawharrisxo.blob.core.windows.net

Tampon Use Girl Do Tampons Qualify For Hsa tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. did you know that you can access qualifying lola products for period care and sexual wellness by using your. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. The irs has a broad. Do Tampons Qualify For Hsa.

From www.gosupps.com

Flex Menstrual Discs Disposable Period Discs Tampon & Pad Do Tampons Qualify For Hsa the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. the recent changes in legislation. Do Tampons Qualify For Hsa.

From trackhsa.com

TrackHSA About HSA Record Keeping Do Tampons Qualify For Hsa the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. The irs has a broad list of expenses related to medical, dental, and. the same hsa eligibility status. Do Tampons Qualify For Hsa.

From www.gosupps.com

Flex Menstrual Discs Disposable Period Discs Tampon, Pad, and Cup Do Tampons Qualify For Hsa did you know that you can access qualifying lola products for period care and sexual wellness by using your. this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. the bill. Do Tampons Qualify For Hsa.

From www.youtube.com

HDHP High Deductible Health Plan, YouTube Do Tampons Qualify For Hsa did you know that you can access qualifying lola products for period care and sexual wellness by using your. tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. The irs has a broad list of expenses related to medical, dental, and. the recent changes in legislation known as. Do Tampons Qualify For Hsa.

From slideplayer.com

Exhibit 8.14 Distribution of Covered Workers with the Following Annual Do Tampons Qualify For Hsa this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. the recent changes in legislation. Do Tampons Qualify For Hsa.

From www.pinterest.com

You Can Finally Use FSA or HSA Money to Buy Pads and Tampons in 2020 Do Tampons Qualify For Hsa the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. did you know that you can access qualifying lola products for period care and sexual wellness by using your. the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. this. Do Tampons Qualify For Hsa.

From blog.healthequity.com

There’s still time to get 2022 tax savings by contributing to your HSA now Do Tampons Qualify For Hsa the bill allows products including tampons, pads, liners, cups, sponges, and other similar products used by individuals with respect. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. the recent. Do Tampons Qualify For Hsa.

From kidspot.co.nz

How to insert tampons School Age Kidspot NZ Do Tampons Qualify For Hsa this includes tampons, pads, period underwear, menstrual cups, menstrual discs, reusable cloth pads, and even. the recent changes in legislation known as the cares act has reclassified menstrual hygiene products to be treated as any. tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. did you know. Do Tampons Qualify For Hsa.

From help.ihealthagents.com

HSA, HRA, HEALTHCARE FSA AND DEPENDENT CARE ELIGIBILITY LIST Do Tampons Qualify For Hsa the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. did you know that you can access qualifying lola products for period care and sexual wellness by using your. The irs has a broad list of expenses related to medical, dental, and. tampons are eligible for reimbursement with a flexible. Do Tampons Qualify For Hsa.

From www.gosupps.com

Flex Menstrual Discs Disposable Period Discs Tampon & Pad Do Tampons Qualify For Hsa tampons are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), and a health. the same hsa eligibility status for tampons applies to flexible spending accounts (fsas) and health reimbursement arrangements. did you know that you can access qualifying lola products for period care and sexual wellness by using your. this includes. Do Tampons Qualify For Hsa.